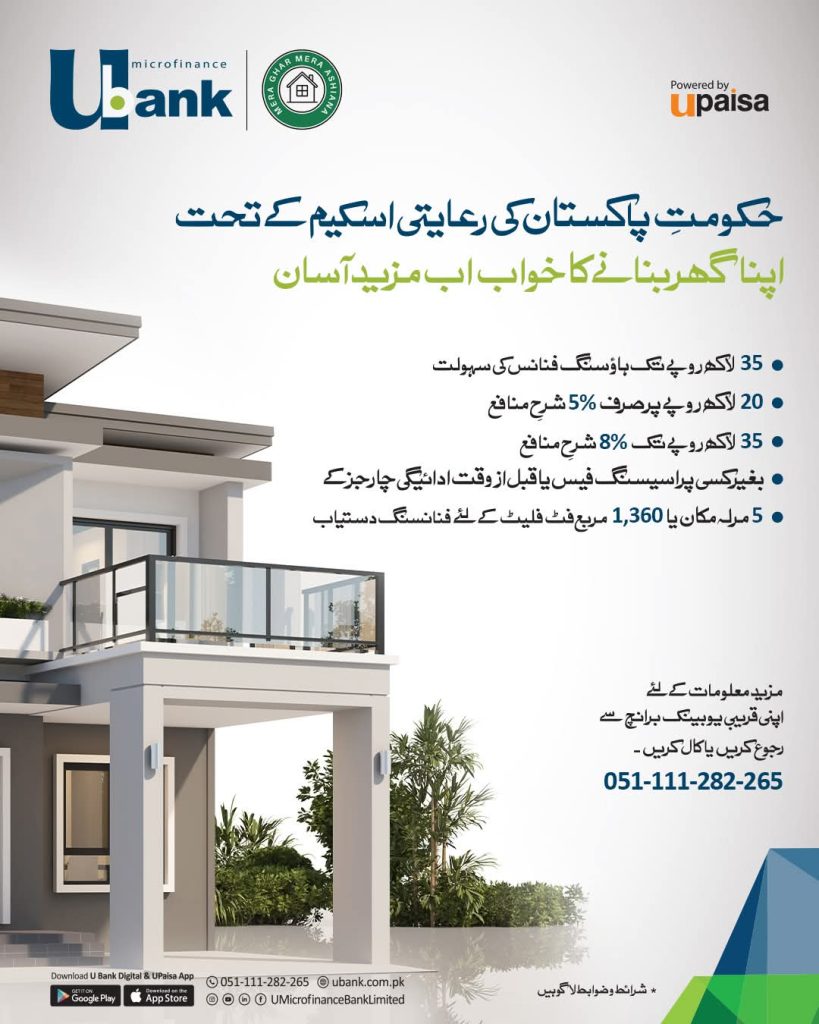

Upaisa Loan Scheme 2026 for Mera Ghar Mera Pakistan – Easy Home Financing

Owning a house is a dream for every family in Pakistan. Due to high construction costs and expensive loans, many people are unable to build or buy their own home. To solve this problem, the Government of Pakistan has launched a special housing finance program called “Mera Ghar Mera Pakistan”.

This scheme is offered through U Microfinance Bank, with digital support from Upaisa. The main goal of this loan scheme is to help low and middle-income families build or buy their own house on easy terms and low interest rates.

In this article, we will explain everything about the Mera Ghar Mera Pakistan Loan Scheme in very easy English.

What Is Mera Ghar Mera Pakistan Scheme?

Mera Ghar Mera Pakistan is a government-supported housing finance scheme. It allows eligible people to get home loans at subsidized interest rates. This means the government helps reduce the interest so that monthly installments become affordable.

The scheme is specially designed for people who:

- Do not already own a house

- Want to build a small house or buy a flat

- Cannot afford high bank interest rates

Bank Offering This Loan

This housing loan is provided by:

U Microfinance Bank

Powered by Upaisa Digital Platform

U Microfinance Bank is known for providing easy and accessible loans to common citizens across Pakistan.

Maximum Loan Amount

Under this scheme, applicants can get:

- Up to Rs. 3.5 million (35 lakh rupees) housing finance

This amount can be used for:

- Building a house

- Buying a ready house

- Purchasing a flat

Interest Rates (Very Important)

One of the biggest benefits of this scheme is its low interest rate.

Subsidized Interest Structure

- Up to Rs. 20 lakh → Only 5% interest rate

- Up to Rs. 35 lakh → 8% interest rate

These rates are much lower than normal bank housing loans, making this scheme very affordable for common people.

Property Size Covered Under This Scheme

The loan can be used for:

- 5 Marla house, or

- Flat up to 1,360 square feet

This makes the scheme ideal for small families living in cities and towns.

Fixed Price and No Hidden Charges

Another strong feature of this loan scheme is:

- Fixed pricing

- No processing fee

- No early repayment charges

This means:

- You can pay back the loan earlier without extra cost

- There are no hidden or surprise charges

Who Can Apply for Mera Ghar Mera Pakistan Loan?

Although detailed eligibility rules are shared by the bank, generally the scheme is suitable for:

- Pakistani citizens

- Salaried persons

- Self-employed individuals

- People with a regular income source

- Individuals who do not already own a house

Final eligibility depends on:

- Income level

- Credit history

- Bank verification

Why This Scheme Is Important for Pakistan

Housing is one of the basic needs of life. Unfortunately, many families in Pakistan live in rented houses all their lives. The Mera Ghar Mera Pakistan Scheme helps in:

- Reducing housing shortage

- Supporting low-income families

- Promoting legal housing construction

- Improving living standards

This scheme is also helpful for the economy as it boosts the construction sector and creates jobs.

Benefits of Mera Ghar Mera Pakistan Loan Scheme

Here are the main benefits:

1. Low Interest Rates

Interest rates starting from only 5%, which is rare in Pakistan.

2. Government Support

The scheme is backed by the Government of Pakistan, making it trustworthy.

3. Easy Installments

Low interest means smaller monthly installments.

4. No Hidden Charges

No processing fees or early payment penalties.

5. Suitable for Small Homes

Ideal for 5 marla houses and small flats.

How to Get More Information or Apply?

To get more details or start the application process, you can:

- Visit your nearest U Microfinance Bank branch

- Call the official helpline

Official Contact Number

📞 051-111-282-265

You can also use:

- U Bank Digital App

- Upaisa App

These apps are available on Google Play Store and Apple App Store.

Documents Required (General Idea)

Although exact requirements are shared by the bank, usually you may need:

- CNIC

- Income proof

- Property documents

- Bank account details

The bank staff will guide you step by step.

Things to Remember

- Loan approval depends on eligibility

- Terms and conditions apply

- Property verification is mandatory

- Installments must be paid on time

Final Words

The Mera Ghar Mera Pakistan Loan Scheme is a golden opportunity for people who want to own a home but cannot afford expensive loans. With low interest rates, easy terms, and government support, this scheme brings hope to thousands of families across Pakistan.

If you are dreaming of building your own house or buying a small flat, this scheme can turn your dream into reality.

For latest updates and official guidance, always contact U Microfinance Bank directly.