SBP Mera Ghar Mera Ashiana Loan Scheme 2025 Online Registration

The State Bank of Pakistan (SBP) has introduced the Mera Ghar – Mera Ashiana Loan Scheme 2025 to help Pakistani citizens build or buy their own homes. This program is designed to promote affordable housing finance and provide support to people who do not already own a house. It offers a special markup subsidy and risk-sharing mechanism so that more families can have a safe and secure place to live. Check PM Electric Bike Scheme.

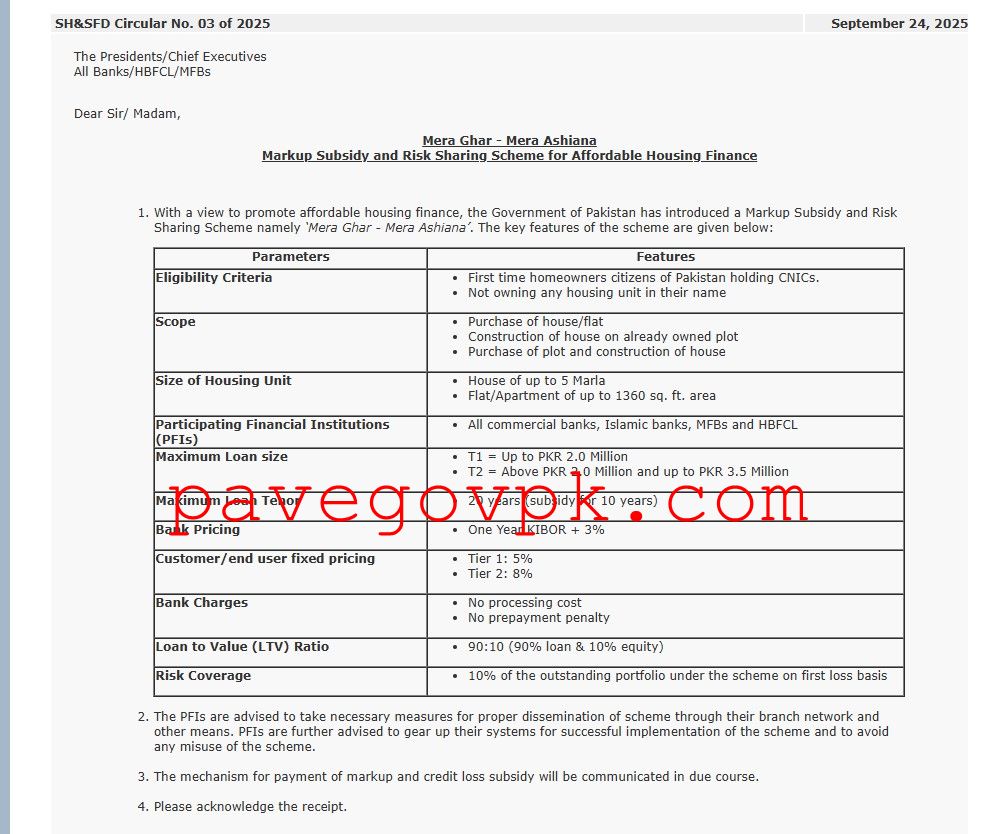

Mera Ghar Mera Ashiana Loan Scheme 2025

The main aim of the scheme is to make housing more affordable for people in Pakistan. With rising property prices and high financing costs, many families struggle to buy or build their first home. This loan scheme reduces the financial burden through lower interest rates and government support.

Eligibility Criteria for Mera Ghar Mera Ashiana Loan Scheme 2025

To apply for this scheme, you must meet the following conditions:

- You must be a first-time homeowner.

- You should be a Pakistani citizen with a valid CNIC.

- You should not own any house or flat in your name.

This ensures that the facility benefits those who genuinely need housing support.

Scope of the Loan

The scheme covers different housing needs. Applicants can use the loan for:

- Purchase of a house or flat.

- Construction of a house on an already owned plot.

- Purchase of a plot and construction of a house on it.

This makes the scheme flexible and suitable for different housing requirements.

Size of Housing Units in Mera Ghar Mera Ashiana Loan Scheme

The scheme allows financing for small- and medium-sized housing units:

- House: Up to 5 Marla.

- Flat/Apartment: Up to 1360 square feet.

This limit ensures that the scheme targets affordable and modest homes.

Participating Financial Institutions

All major banks are part of this scheme. These include:

- Commercial Banks

- Islamic Banks

- Microfinance Banks (MFBs)

- House Building Finance Corporation Limited (HBFCL)

Applicants can approach any of these institutions to apply for financing.

Loan Amount

The maximum loan sizes are divided into tiers:

- Tier 1 (T1): Up to PKR 2.0 Million

- Tier 2 (T2): Above PKR 2.0 Million and up to PKR 3.5 Million

This tier system gives flexibility depending on the housing need and budget.

Loan Tenor

- The maximum loan period is 20 years.

- The government provides markup subsidy for the first 10 years.

This long repayment period makes installments affordable for ordinary families.

Pricing and Markup

The scheme offers very low and fixed markup rates for the customer:

- Tier 1 (T1): 5% fixed rate

- Tier 2 (T2): 8% fixed rate

Banks normally charge higher rates, but the government covers the difference through subsidy.

Bank Charges

To make the scheme more attractive and affordable, the following rules apply:

- No processing cost will be charged.

- No prepayment penalty will apply if you pay back early.

This encourages people to apply without worrying about extra hidden costs.

Loan to Value Ratio (LTV)

- The LTV ratio is 90:10.

- This means the bank provides 90% of the loan amount, while the customer only contributes 10% as equity.

For example, if your house costs PKR 2 million, you only need to pay PKR 200,000 upfront, while the bank will provide the rest.

Risk Coverage

To reduce the risk for banks and make financing easier:

- The government covers 10% of the outstanding portfolio under the scheme on a first-loss basis.

This encourages banks to lend confidently to low- and middle-income families.

Benefits of the Scheme

The Mera Ghar – Mera Ashiana Loan Scheme 2025 offers many advantages:

- Affordable monthly installments due to low markup.

- Opportunity for first-time buyers to finally own a home.

- Long loan tenor of 20 years.

- Wide range of banks and financial institutions available.

- No hidden charges, no prepayment penalty.

- Strong government support to make the scheme secure.

How to Apply for Mera Ghar Mera Ashiana Loan Scheme 2025

Here are the steps to apply for the loan:

- Visit any participating commercial bank, Islamic bank, MFB, or HBFCL.

- Fill in the housing finance application form.

- Provide all required documents, such as CNIC, income proof, property documents, and photographs.

- The bank will check your eligibility under the scheme.

- Once approved, the loan will be disbursed according to your housing plan.

The SBP Mera Ghar Mera Ashiana Loan Scheme 2025 is a golden opportunity for Pakistani citizens who dream of owning a home but cannot afford high financing costs. With government subsidy, long repayment time, and easy terms, this scheme makes housing more accessible for low- and middle-income families.

It is not just a loan program; it is a step towards financial inclusion, better living standards, and economic growth in Pakistan. For details check https://www.sbp.org.pk/smefd/circulars/2025/C3.htm.